Property Development Finance

Property development finance is a specialised form of funding designed to support the construction and development of real estate projects. Many lenders offer a variety of property loan options that can be tailored to suit different financial positions and needs, depending on the specific circumstances of the borrower. hhn

Types of Property Development Finance

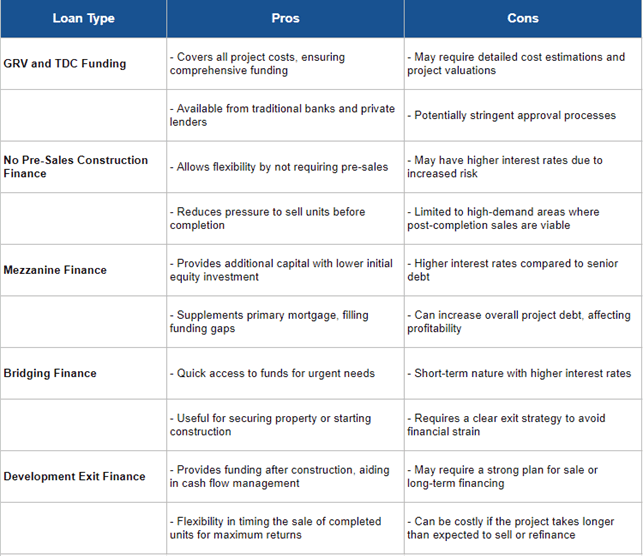

There are several types of property development finance, each offering distinct benefits and challenges. The table below compares key options, including GRV and TDC Funding, No Pre-Sales Construction Finance, Mezzanine Finance, Bridging Finance, and Development Exit Finance.

By highlighting their pros and cons, this summary helps developers choose the most suitable financing for their projects.

Key Considerations for Securing Finance

Eligibility and Application Process

Lenders generally require detailed project plans, financial projections, and evidence of experience to assess eligibility for property development finance.

Loan-To-Cost (Ltc) and Loan-To-Gross Development Value (LTGDV)

Major banks often use key metrics like LTC and LTGDV in property development finance. LTC refers to the percentage of the total project cost covered by the loan, while LTGDV represents the loan amount as a percentage of the project’s gross development value. These ratios help assess the risk and determine the loan amount.

Interest Rates and Fees

Interest rates and fees vary depending on the type of finance you are looking to secure. Typically, they are influenced by the project’s risk profile, market conditions, and the developer’s creditworthiness. Understanding these costs is crucial for accurate financial planning.

Security Requirements

Most property development finance options require security, typically in the form of a mortgage on the property being developed. Additional collateral may also be needed, depending on your requirements. Security helps protect our investment in your project and influences the terms of the loan.

Specialised Financing Options

100% Development Finance

Some lenders may provide 100% development finance options under specific conditions, such as strong project feasibility and experienced developers. It allows for full funding without upfront capital.

Joint Venture Finance

Joint venture finance involves partnering with investors to fund the development project. This model allows for shared risk and profit, providing an alternative financing route. Joint ventures are beneficial for large projects where equity and expertise can be pooled.

Modular Development Finance

Modular development finance supports innovative construction methods, such as modular building. This type of finance caters to the unique needs of modular projects, offering flexible terms and quick approval processes. It’s ideal for developers focusing on sustainable and efficient construction techniques.

Support for Developers

Financing for First-Time Developers

First-time developers often face unique challenges in securing finance. Tailored support and guidance can help navigate the complexities of the process, ensuring access to suitable funding options. Special considerations may include lower equity requirements and mentorship programs.

Bad Credit Options

Developers with bad credit can still access financing options, though terms may vary. There are specialised loan products designed to accommodate credit challenges, often requiring additional security or higher interest rates. These options, such as higher interest rates and additional security, provide a pathway to funding despite past financial difficulties.

On-Call Finance Solutions

On-call finance solutions offer flexible funding for off-the-plan buyers and pre-sale commitments. These customized solutions are designed to meet the specific needs of developers, ensuring timely access to capital when required. They provide a safety net for managing unexpected financial requirements.

Why Choose Maxiron Capital?

Expertise and Experience

We specialise in commercial lending, providing industry insights and knowledge to guide borrowers through the financing process. Our experienced team understands the complexities of commercial property loans and is dedicated to providing the best solutions for our clients.

Customised Solutions

We offer loans tailored to meet individual business needs, ensuring the best fit for each client. Our flexible loan structures and personalised service set us apart from traditional lenders.

Competitive Rates

We offer access to a wide range of financing options, and competitive rates may be available depending on the client’s unique situation and market conditions. As a direct lender, we have more flexibility to find the best terms and conditions for our clients.

Client-Focused Approach

We are dedicated to supporting clients throughout the loan process, offering personalised service and guidance. Our client-focused approach ensures that each borrower receives the attention and support they need to achieve their financial goals.

FAQs

Property developers secure financing through a combination of equity, loans, and specialised finance products. The choice of finance depends on the project type, scale, and developer experience.

Investment property finance refers to loans specifically designed for purchasing or developing properties intended for rental or resale. These loans are structured to optimise returns on investment.